The article below was written by C. Edward Kelso and posted to coinivore.com on March 1, 2021.

It is another example of a mainstream company doing a 180 on cryptocurrencies after years of contributing to the F.U.D. (Fear, Uncertainty, and Doubt) surrounding cryptocurrencies.

It is natural to fear what you do not know, and financial institutions have a reason to fear cryptocurrencies because it gives YOU an option when it comes to YOUR money.

The Cryptocurrency Industry is a $1.7 trillion dollar industry is at a point where serious investors and institutions are starting to pay attention.

FOLLOW THE MONEY!

Do not get into the cryptocurrency space because you see celebrities and institutional investors are putting their money into cryptocurrencies. Conduct your own due diligence before you jump in because cryptocurrencies are volatile and you need to know what you are doing or you could lose everything you put into this space.

As I am typing this, BITCOIN just reached a new HIGH of $60,000 per coin. Three weeks ago it reached a new high only to see a pullback to $43,000 per coin.

Start your cryptocurrency education today by clicking on the “Cryptocurrency Education” link in the main menu above so that you may make an educated decision when you do join this space.

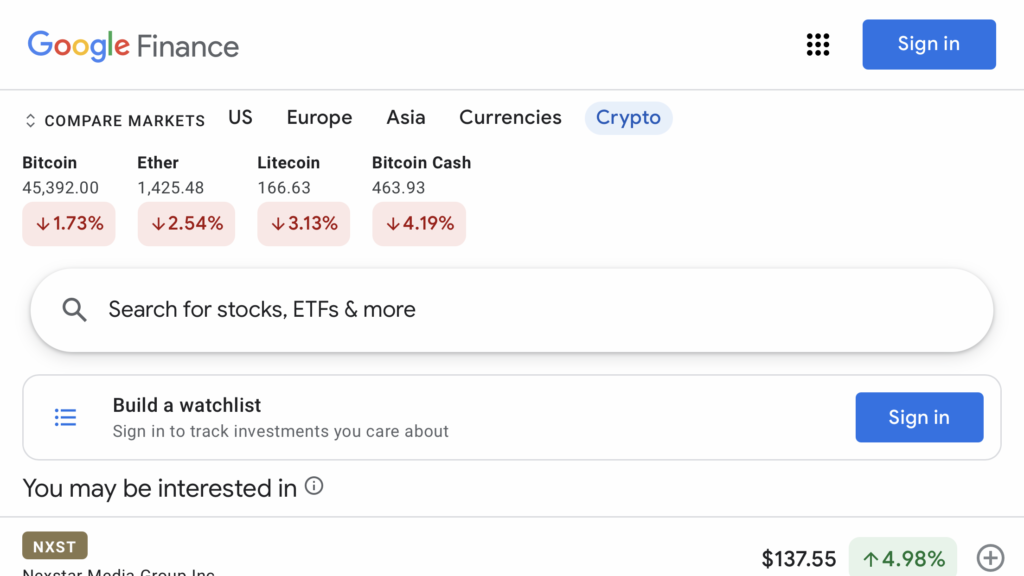

The four cryptocurrencies listed on Google Finance are as follows:

- Bitcoin – the number one cryptocurrency by market cap according to coinmarketcap.com

- Ethereum – the number two cryptocurrency by market cap

- Litecoin – the number nine cryptocurrency by market cap

- Bitcoin Cash – the number 11 cryptocurrency by market cap

They are also four of the five cryptocurrencies traded by Copy Pro Traders with the fifth being Chainlink which is the number 10 cryptocurrency by market cap. Copy Pro Traders allows you to follow a professional trader while maintaining control of your cryptocurrency and protecting your gains by storing them in a stablecoin.

Read the article below, leave a comment, and subscribe to my blog so that you may be notified when new content is posted.

The article below can be found by going to the following website URL:

Suddenly, and then all at once.

Browser-based Google Finance slyly listed a “crypto” tab among its offerings this week.

The facing page appears, as usual, allowing user customization, including market comparisons by country, a basket of currencies tab, and now a “crypto” tab.

It’s quite a subtle form of capitulation for Google.

The online behemoth has had a love/hate relationship with cryptocurrencies for years. It was only two or so years ago, for example, Scott Spencer, Vice President of Product Management, Ads Privacy and Safety at Google rocked markets by acknowledging an effective ban on advertising related to cryptocurrencies, lumping the ecosystem in with scams and dangers to online surfers.

Months later it would purge crypto content from its YouTube platform. It would insist the scrubbing came as a result of an error, but such “errors” continue into the present day.

Subsequent messaging from the company about a ban of crypto was muddled, contradictory, and often confusing.

In the background, however, Google appeared to have other intentions in mind.

Just weeks ago when Blockchain.com announced having raised $120M in an investment round, Google Ventures was quietly tucked-in among contributors.

Around the same time, the BitPay app was added to Google Play … after headline-making battles and removals also going back years.

Clearly, something is afoot at Google.

Google Finance began more than a dozen years ago as an answer to first-movers in the space such as Yahoo! Finance. And while the new Google Finance “crypto” tab lists only four assets (BTC, ETH, LTC, and BCH), it is not immediately clear why that quartet was highlighted for the rollout.

If I were a betting man, something tells me the “crypto” tab might expand considerably in the coming months and years. Demand for cryptocurrency knowledge and literacy is simply through the roof, invading all sectors of finance and popular culture. To be in the information game, to be the go-to search engine, and NOT have a dedicated reference page is leaving a lot of advertising money and clicks on the table.

And by clicking on a specific coin inside the new tab, users have access to a price line chart over significant spans of time (a funny aside is that Google Finance has a Previous Close price, hinting at an outdated legacy understanding).

Under Key Stats, each coin gets a brief, Wikipedia-inspired explanation about its significance.

Overall, the Google Finance “crypto” tab is underwhelming. But that’s how it starts. Giant global corporations dismiss, ignore, and then attempt to throttle and thwart and ban. And when all of the measures prove ineffective against a tidal wave of interest, whatever remaining magic inside of freer markets does its thing.

Keep an eye out ashore. A tsunami isn’t far behind.

Terrific data. Thanks.

legit essay writing services https://writeadissertation.com pay to have essay written https://paperwritingservicecheap.com

With thanks. Ample write ups!

[url=https://essaywritingservicelinked.com/]writing a college essay[/url] bespoke essay writing services [url=https://essaywritingservicetop.com/]writing a persuasive essay[/url] masters essay writing service

Thank you! Loads of knowledge!

do my accounting homework i always do my homework at the last minute my child takes too long to do homework i want to do my homework

Cheers. A good amount of postings!

free casino slot games online [url=https://bestonlinecasinoreal.us/]mgm online casino bonus code[/url] online casino rating

You’ve made your point extremely well..

buy essay paper [url=https://seoqmail.com/]cheap essay papers for sale[/url]

Thanks, Valuable stuff.

the app that writes essays for you who can write my research paper for me fake essay writer

Cheers! A lot of information!

write my essay fast write me my essay when revising a narrative essay the writer should include

This is nicely put! .

[url=https://customthesiswritingservice.com/]writing a thesis[/url] tentative thesis [url=https://writingthesistops.com/]how to write thesis[/url] define thesis statement

You mentioned that very well.

[url=https://essaywritingservicelinked.com/]college essay writing services[/url] good essay writing service [url=https://essaywritingservicetop.com/]good essay writing service[/url] best essay writing service in usa

You have made the point.

free writing assistant college essay help online writing helper essay writing helper

[url=https://essaywritingservicehelp.com/]writing a scholarship essay[/url] mba essay writing service [url=https://essaywritingservicebbc.com/]college essay writing service[/url] good essay writing service

being a college student essay https://homeworkcourseworkhelps.com

Effectively spoken really. !

mba essay help essays writing help essaytyper essay writing help online

Reliable posts. Appreciate it!

pay for a paper to be written pay to have essay written pay for essay reviews buy my essay

[url=https://phdthesisdissertation.com/]phd proposal[/url] dissertations help [url=https://writeadissertation.com/]buy dissertation paper[/url] writing your dissertation

writing essays in college https://studentessaywriting.com

Superb material. Thanks.

[url=https://argumentativethesis.com/]thesis proposal example[/url] thesis statement about community service [url=https://bestmasterthesiswritingservice.com/]thesis template[/url] writing a thesis

Nicely expressed really. .

[url=https://writingpaperforme.com/]research paper writers[/url] paper writers cheap [url=https://custompaperwritersservices.com/]how to write a response paper[/url] paper writing

Whoa tons of terrific advice!

dissertation writers phd.research nursing dissertation help writing your dissertation

[url=https://homeworkcourseworkhelps.com/]do my math homework for me[/url] coursework writing services [url=https://helpmedomyxyzhomework.com/]how do you say do my homework in spanish[/url] i can t do my homework

mit college essay https://writeadissertation.com

You’ve made the point.

thesis statements thesis titles thesis search thesis writer

You actually suggested it exceptionally well!

[url=https://studentessaywriting.com/]essay review service[/url] will writing service [url=https://essaywritingserviceahrefs.com/]legit essay writing services[/url] essay writer help

You made your point.

write my essay paper can i pay someone to do my essay website that writes your essay for you write essay for me

[url=https://essaywritingservicelinked.com/]paper writing services for college students[/url] writing a college admission essay [url=https://essaywritingservicetop.com/]college essay writing services[/url] paper writing services

essay service https://essayservicehelp.com

You’ve made your point.

college paper writers paper writing research paper writer service research paper writer service

Wonderful data, Regards!

[url=https://customthesiswritingservice.com/]explanatory thesis[/url] b ed thesis writing service [url=https://writingthesistops.com/]psychology thesis[/url] thesis help

Terrific posts. Kudos.

dissertation only phd dissertation editing phd writer proposal phd

[url=https://researchproposalforphd.com/]research papers help[/url] research paper proposal [url=https://writingresearchtermpaperservice.com/]proposal essay[/url] research paper writing help

essays writing services https://bestcheapessaywriters.com

Nicely put, With thanks.

write a paper for me write a research paper for me write my research paper paper for me

[url=https://ouressays.com/]term papers for sale[/url] term paper help [url=https://researchpaperwriterservices.com/]buy a research paper[/url] write a research proposal

phd thesis publication https://dissertationwritingtops.com

You definitely made your point.

[url=https://researchproposalforphd.com/]proposal for phd[/url] term paper [url=https://writingresearchtermpaperservice.com/]research paper to buy[/url] custom term paper

Nicely voiced indeed! !

contents of research proposal cheap research paper writing service term paper writing service college term papers

[url=https://essaypromaster.com/]essay writter[/url] how to write a reflective paper [url=https://paperwritingservicecheap.com/]ai essay writer[/url] cheap paper writers

college board essays https://helptowriteanessay.com

Helpful advice. Cheers!

writing an opinion essay write a summary for me do my essay cheap write my essay for me no plagiarism

You revealed it exceptionally well!

best online resume writing service seo article writing service cheap essay writing service us service to others essay

[url=https://essaypromaster.com/]do my paper[/url] do my research paper [url=https://paperwritingservicecheap.com/]write my papers[/url] how to write an abstract for a research paper

websites to type essays https://essaywritingservicetop.com

Nicely put, Thank you!

[url=https://hireawriterforanessay.com/]write my essay in 1 hour[/url] essay writer com [url=https://theessayswriters.com/]write my essay paper[/url] write essays for you

Whoa quite a lot of good tips!

[url=https://payforanessaysonline.com/]pay to write essay[/url] order essay cheap [url=https://buycheapessaysonline.com/]order of an essay[/url] order essay online

Many thanks. Good stuff!

homework do my math homework pay someone to do my homework online do my online math homework

[url=https://writingpaperforme.com/]academic paper writer[/url] write my paper for me cheap [url=https://custompaperwritersservices.com/]write a paper for me[/url] how to write a scientific paper

essay on social service https://bestpaperwritingservice.com

You actually stated that adequately!

papers writers college paper writer write my papers for me write my research papers

Kudos! I enjoy it.

bachelor thesis writing service thesis database thesis topic thesis proposal writing service

Seriously many of fantastic knowledge.

[url=https://writingpaperforme.com/]write papers for me[/url] paying someone to write a paper [url=https://custompaperwritersservices.com/]kindergarten writing paper[/url] how to write an apa paper

Nicely put, Kudos!

homework help pay someone to do my homework do my writing homework coursework writers

You actually said that really well!

how to write an analysis paper do my research paper do my paper essay writers online

[url=https://dissertationwritingtops.com/]proposal phd[/url] best dissertation editing services [url=https://helpwritingdissertation.com/]dissertation help uk[/url] undergraduate dissertation

dissertations writing https://bestonlinepaperwritingservices.com

Cheers. Good information!

[url=https://topswritingservices.com/]best assignment writing service[/url] custom paper writing service [url=https://essaywriting4you.com/]writing a persuasive essay[/url] writing essays online

You made your point pretty effectively..

paper writers for hire write my term paper write papers for me pay someone to write my paper

[url=https://customthesiswritingservice.com/]argumentative essay thesis[/url] define thesis statement [url=https://writingthesistops.com/]b ed thesis writing service[/url] thesis editing services

college essay promts https://bestcheapessaywriters.com

You’ve made your position very nicely.!

[url=https://writinganessaycollegeservice.com/]writing service[/url] essay service review [url=https://essayservicehelp.com/]seo article writing service[/url] cheap essay writing service

Truly a lot of excellent knowledge!

custom essays for sale order essay cheap essay writer pay order cheap essays

[url=https://writinganessaycollegeservice.com/]essay write service[/url] essay writing help service [url=https://essayservicehelp.com/]best custom essay writing service[/url] seo article writing service

how to write a good argumentative essay https://payforanessaysonline.com

Many thanks! I value it.

essay thesis good thesis statement thesis proposal writing service thesis writing

[url=https://service-essay.com/]online research paper writing services[/url] buy papers online [url=https://custompaperwritingservices.com/]custom research paper writing service[/url] buy custom papers

how to write an essay in college https://service-essay.com

Fantastic stuff, With thanks!

[url=https://studentessaywriting.com/]best essay writing service australia[/url] resume writing services [url=https://essaywritingserviceahrefs.com/]essay writing service oxford[/url] pro essay writing service

Wonderful data, Thank you.

write my research paper research paper writer college term papers research proposals

You explained that really well!

a thesis thesis statment thesis writing service strong thesis statement

Many thanks, A lot of content!

[url=https://essaywritingservicelinked.com/]professional cv writing service[/url] top ten essay writing services [url=https://essaywritingservicetop.com/]professional essay writing service[/url] cheap assignment writing service

With thanks! I value this.

[url=https://essaytyperhelp.com/]paperhelp[/url] help writing essay [url=https://helptowriteanessay.com/]essaytyper[/url] argumentative essay

Many thanks! Plenty of write ups.

australian essay writing service term paper writing service essay help service essay writing service usa

[url=https://customthesiswritingservice.com/]good thesis[/url] thesis titles [url=https://writingthesistops.com/]write a thesis[/url] writing a thesis statement

good thesis statement https://bestcheapessaywriters.com

Amazing plenty of great data!

paper writers for college how to write a philosophy paper how to write an abstract for a research paper essay writers

Superb tips. Thanks!

essay bot writing help help with essay writing assignment help

Superb forum posts. Kudos.

[url=https://topswritingservices.com/]essay writing websites[/url] writing a conclusion for an essay [url=https://essaywriting4you.com/]writing a good essay[/url] what is the best essay writing service

Tips certainly taken.!

dissertation writing service best dissertation dissertations best dissertation

[url=https://theessayswriters.com/]write my research paper for me[/url] write my essay for me free [url=https://bestcheapessaywriters.com/]essay writer review[/url] write a essay

writing essay about yourself https://hireawriterforanessay.com

Whoa all kinds of excellent advice!

best paper writing services spongebob writing essay argumentative essay writing write my essay service

Whoa a good deal of wonderful advice.

thesis research thesis thesis statement meaning thesis statment

[url=https://hireawriterforanessay.com/]make an essay[/url] write my essay cheap [url=https://theessayswriters.com/]professional essay writers[/url] essay writer website

i need a ghostwriter https://writingpaperforme.com

Really quite a lot of beneficial tips.

hire someone to do my homework homework help cpm do my homework for money cpm homework help

Fantastic posts, Thanks a lot!

[url=https://service-essay.com/]custom research paper writing services[/url] online paper writing service [url=https://custompaperwritingservices.com/]professional paper writing service[/url] pay for paper

Terrific facts, Thanks a lot.

homework help coursework do my math homework i don t want to do my homework

[url=https://writingpaperforme.com/]how to write a reflective paper[/url] how to write an abstract for a research paper [url=https://custompaperwritersservices.com/]essay writer free[/url] write my paper reviews

how to write a literary criticism essay https://domycollegehomeworkforme.com

Truly plenty of superb facts!

thesis statement thesis titles thesis writing service good thesis

Truly plenty of helpful info.

[url=https://writinganessaycollegeservice.com/]letter writing service[/url] paper writing services legitimate [url=https://essayservicehelp.com/]essay writing services[/url] academic essay writing service

Nicely put, Kudos.

write my term paper write a research paper how to write a reflection paper professional essay writers

[url=https://englishessayhelp.com/]help writing essay[/url] essay writing service [url=https://essaywritinghelperonline.com/]the college essay guy[/url] essay help

writing a dbq essay https://studentessaywriting.com

You actually explained it terrifically.

[url=https://hireawriterforanessay.com/]essay writter[/url] best essay writers [url=https://theessayswriters.com/]best essay writers[/url] write an essay for me

You said it very well.!

dissertation assistance writing dissertation doctoral dissertation dissertation service

[url=https://domyhomeworkformecheap.com/]do my homework for free[/url] pay someone to do my homework [url=https://domycollegehomeworkforme.com/]cpm homework[/url] do my homework for money

college scholarship essay prompts https://homeworkcourseworkhelps.com

Thanks. Good information.

[url=https://theessayswriters.com/]write this essay for me[/url] do my essay [url=https://bestcheapessaywriters.com/]write paper for me[/url] professional essay writers

Many thanks, I value this.

[url=https://researchproposalforphd.com/]proposal introduction[/url] research paper writers [url=https://writingresearchtermpaperservice.com/]proposal writer[/url] research paper writers

Kudos. Very good information.

proposal research proposal writer buy term paper research paper writer services

[url=https://essaywritingservicehelp.com/]urgent essay writing service[/url] trusted essay writing service [url=https://essaywritingservicebbc.com/]term paper writing service[/url] writing a compare and contrast essay

sat essay writing help https://helpwritingdissertation.com

Tips certainly regarded.!

dissertation def dissertation proquest dissertations dissertation writer

Thank you. Wonderful stuff!

college essays writing best essay writing service review writing a conclusion for an essay paper writing service

[url=https://writinganessaycollegeservice.com/]real essay writing service[/url] best essay writing service in usa [url=https://essayservicehelp.com/]essay help service[/url] essay writing site

technical writing service https://custompaperwritingservices.com

Whoa all kinds of terrific data.

[url=https://customthesiswritingservice.com/]thesis writer[/url] thesis paper [url=https://writingthesistops.com/]thesis statements[/url] good thesis statements

You actually mentioned that wonderfully!

phd dissertation help writing help dissertation abstracts international doctoral dissertation

Awesome postings. Thank you!

[url=https://phdthesisdissertation.com/]dissertation meaning[/url] phd dissertation [url=https://writeadissertation.com/]dissertation writers[/url] what is a phd

Amazing all kinds of wonderful data!

pay to write essay pay for college papers order essay online buy essays

[url=https://essaywritingservicehelp.com/]best essay writing website[/url] the best essay writing service [url=https://essaywritingservicebbc.com/]custom essay writing[/url] scholarship essay writing service

how to write a synthesis essay https://essaywritingservicehelp.com

Thank you, I like this!

[url=https://ouressays.com/]term paper[/url] proposal research [url=https://researchpaperwriterservices.com/]research proposals[/url] research proposals

Very good postings. Thanks.

[url=https://service-essay.com/]research paper writing service[/url] buy a paper for college [url=https://custompaperwritingservices.com/]college paper writing service[/url] paper writing services

Beneficial postings. Appreciate it.

paper writer services online essay writer write my paper for cheap website that writes papers for you

[url=https://researchproposalforphd.com/]research paper services[/url] cheap research paper writing service [url=https://writingresearchtermpaperservice.com/]write my term paper[/url] parts of a research proposal

online cv writing services https://writeadissertation.com

Really tons of helpful knowledge!

thesis writing service how to write thesis a thesis thesis help

Kudos, Awesome information.

[url=https://payforanessaysonline.com/]pay for essay online[/url] pay for an essay [url=https://buycheapessaysonline.com/]where to buy essays online[/url] pay for essay papers

he was disappointed when he found the beach to be so sandy and the sun so sunny far the soft touch of a loved ones hand brings comfort and reassurance

Amazing information. Thanks a lot!

[url=https://essayssolution.com/]online essay writers[/url] write my essay for cheap [url=https://cheapessaywriteronlineservices.com/]write an essay for me[/url] essay writer no plagiarism

You actually expressed it wonderfully.

write a essay for me website that writes essays for you essay writer review write paper for me

Kudos! Terrific stuff.

define dissertation dissertation writing service phd thesis define dissertation

[url=https://topswritingservices.com/]best finance essay writing service[/url] research paper writing service [url=https://essaywriting4you.com/]cheap custom essay writing service[/url] college application essay writing service

good essay writing services https://dissertationwritingtops.com

Very good facts, With thanks.

[url=https://dissertationwritingtops.com/]phd weight loss[/url] dissertation writer [url=https://helpwritingdissertation.com/]writing help[/url] dissertation abstract

Thank you. Loads of info!

dissertation abstracts international dissertation dissertation help writing a dissertation

You actually explained this wonderfully!

essay writting writing essay spanish essay writing service resume writing services

[url=https://englishessayhelp.com/]help with essay writing[/url] help with essay writing [url=https://essaywritinghelperonline.com/]essaytyper[/url] assignment help

theses meaning https://phdthesisdissertation.com

With thanks! Fantastic stuff!

[url=https://essaywritingservicelinked.com/]essay writing app[/url] coursework writing service [url=https://essaywritingservicetop.com/]best rated essay writing service[/url] cover letter writing service

Well voiced certainly. !

online essay writers automatic essay writer write my essay for me free do my essay

You’ve made your position quite nicely..

personal statement writing service term paper writing services the best essay writing service admission essay service

[url=https://essaypromaster.com/]write a paper[/url] pay someone to write my paper [url=https://paperwritingservicecheap.com/]paper writer[/url] professional paper writers

dissertation statistics https://researchproposalforphd.com

Wonderful information. Thank you!

[url=https://bestpaperwritingservice.com/]pay to write paper[/url] paper help [url=https://bestonlinepaperwritingservices.com/]buy a paper for college[/url] pay someone to write a paper

With thanks! Good stuff!

online essay writers essay writers online write my essay for me write my essays online

Fine write ups. Thanks!

thesis template college thesis a thesis statement research thesis

[url=https://customthesiswritingservice.com/]thesis[/url] thesis sentence [url=https://writingthesistops.com/]thesis statement[/url] thesis topic

how long should a college essay be https://essaywriting4you.com

Tips nicely applied!.

thesis help doctoral thesis strong thesis statement how to write thesis

Thank you, Quite a lot of content.

best dissertation dissertation abstract phd dissertation writing phd dissertation

[url=https://researchproposalforphd.com/]research proposal cover page[/url] buy term papers online [url=https://writingresearchtermpaperservice.com/]termpaper[/url] college term papers

personal statement college essay https://custompaperwritingservices.com

You actually said it really well!

dissertation writers dissertation assistance dissertations online dissertation proposal

Great data. Many thanks!

[url=https://essayssolution.com/]ai essay writer[/url] do my essay for me [url=https://cheapessaywriteronlineservices.com/]do my essay for me[/url] write my research paper for me

Nicely put, Many thanks.

reddit do my homework cpm homework my homework my homework

[url=https://domyhomeworkformecheap.com/]do my math homework for me[/url] do my homework [url=https://domycollegehomeworkforme.com/]can you do my homework[/url] should i do my homework

purpose of writing an essay https://essaywritingservicebbc.com

You actually explained that fantastically!

pay for essay pay someone to write paper essays for sale order essay

Superb knowledge. Thanks a lot.

[url=https://writinganessaycollegeservice.com/]resume writing services[/url] writing a persuasive essay [url=https://essayservicehelp.com/]best essay writing service in usa[/url] cheapest essay writing service uk

This is nicely put! !

research paper proposal research proposal research paper helper write my term paper

[url=https://writingpaperforme.com/]write my paper reviews[/url] paper writing service [url=https://custompaperwritersservices.com/]write paper for me[/url] do my paper

undergraduate dissertation https://service-essay.com

home remedy viagra roman viagra mexican viagra

You revealed that really well!

my essay service college essay writing service cv writing service cheap custom essay writing services

Good write ups. Cheers!

[url=https://topswritingservices.com/]writing an informative essay[/url] college paper writing services [url=https://essaywriting4you.com/]writing service essay[/url] cheap custom writing service

This is nicely expressed! !

professional essay writing essay services writing an argumentative essay best online essay writing services

[url=https://essaypromaster.com/]write my research paper for me[/url] paper writers for college [url=https://paperwritingservicecheap.com/]write my paper[/url] do my paper

write my essay today https://cheapessaywriteronlineservices.com

Nicely put, Thanks a lot!

[url=https://ouressays.com/]custom research paper writing services[/url] buy research paper [url=https://researchpaperwriterservices.com/]proposal introduction[/url] write my research paper for me

Nicely put, Thanks a lot.

research proposal cover page proposal research proposal essay custom research paper writing services

[url=https://domyhomeworkformecheap.com/]cpm homework help[/url] can you do my homework [url=https://domycollegehomeworkforme.com/]my homework[/url] do my homework for money

how to write an intro for an essay https://writinganessaycollegeservice.com

Thanks, Ample tips.

write my paper for cheap paper writing service college papers for sale essay writer free

You said it adequately..

[url=https://studentessaywriting.com/]essay writing service usa[/url] essay writing site [url=https://essaywritingserviceahrefs.com/]online check writing service[/url] best online resume writing service

Приобретайте оборудование надёжности по доступной цене

стабилизаторы напряжения http://stabrov.ru.

Really loads of valuable advice.

best essay writing service to work for medical school essay writing service essay writer help

Thanks. Numerous content.

paper writing service reddit [url=https://essayservicehelp.com/]case study paper writing service[/url] is cheap writing service legit

Электромеханические стабилизаторы напряжения широко применяются в различных областях, включая промышленность, коммерческие и домашние сети. Они обеспечивают надежную и стабильную работу электрооборудования, предотвращая повреждения и сбои, вызванные нестабильным напряжением. Перед выбором электромеханического стабилизатора необходимо учитывать требования и особенности вашей сети и подключаемых устройств.

стабилизатор напряжения 12000вт [url=https://www.stabilizatory-napryazheniya-1.ru]https://www.stabilizatory-napryazheniya-1.ru[/url].

Стандарт ГОСТ Р 50571.1-2013 устанавливает требования к напряжению в электрической сети переменного тока номинальным значением 220/380 В. Это означает, что напряжение фазы в трехфазной системе составляет 380 В, а напряжение между фазой и нулевым проводом составляет 220 В. Такое напряжение используется в промышленности, офисах, торговых центрах и других коммерческих объектах.

стабилизатор напряжения 30 квт [url=http://www.stabilizatory-napryazheniya-1.ru/]http://www.stabilizatory-napryazheniya-1.ru/[/url].

Very good blog you have here but I was curious about if you knew of any community forums that cover the same topics talked about here? I’d really love to be a part of community where I can get feed-back from other experienced people that share the same interest. If you have any recommendations, please let me know. Thanks a lot!

Thank you! I value this!

essay writing examples pdf law school personal statement writing service cv writing service london

You actually mentioned this perfectly!

management essay writing service best cv writing service 2018 personal statement writing service

Thanks. Ample posts!

what is the best write my essay site essay writing websites essay writing services

Perfectly expressed truly! !

a website that writes essays for you cheap essay writing service cv and linkedin writing service

I simply couldn’t go away your web site before suggesting that I actually loved the standard information a person provide for your visitors? Is gonna be again often in order to check up on new posts

With thanks! A good amount of knowledge!

architecture essay writing service [url=https://topswritingservices.com/#]check my essay[/url] professional cover letter writing service uk

Great postings. Regards.

custom lab report writing service [url=https://essayservicehelp.com/]unique essay writing service[/url] what is the last phase of writing an informative essay

Terrific tips. Cheers!

college entrance essay writing service [url=https://topswritingservices.com/#]essay writing[/url] steps to writing an argumentative essay

You mentioned that superbly!

writing an essay [url=https://essayservicehelp.com/]essay writing jobs[/url] accounting essay writing service

Kudos. Fantastic information!

online blackjack fake money reddog casino no deposit bonus online casino deposit

Many thanks, Numerous knowledge.

rollete online [url=https://red-dogcasino.online/#]reddog casino[/url] red dog slots

This is nicely put! !

blackjack real money [url=https://red-dogcasino.online/#]red dog casino 50 free spins no deposit[/url] roulette online with real money

Nicely put, With thanks.

$10 deposit casinos https://red-dogcasino.online/ free blackjack games offline

You said it very well.!

free live blackjack [url=https://red-dogcasino.online/#]red dog casino online[/url] no deposit bonus codes 2020

Amazing a lot of superb material.

free play slots no download red dog no deposit bonus free chips no deposit https://red-dogcasino.online/ free live blackjack [url=https://red-dogcasino.online/#]red dog casino codes[/url] casino games download

Thanks a lot. Very good stuff!

enchanted casino real money red dog casino 100 no deposit bonus codes red dog casino 50 free spins no deposit https://red-dogcasino.online/ red dog casino welcome bonus [url=https://red-dogcasino.online/#]red dog casino no deposit bonus[/url] casino mania slots real money

With thanks! Great stuff.

free chips no deposit casinos reddog casino bonus slots-ahoy https://reddog-casino.site/ tycoon slots [url=https://reddog-casino.site/#]red dog casino free spins no deposit[/url] red dog casino 100 no deposit bonus codes

Information nicely utilized..

wild casino no deposit bonus [url=https://reddog-casino.site/#]dog casino[/url] free blackjack win real money

Cheers! I appreciate this!

play slots for free no download [url=https://reddog-casino.site/#]visa casino[/url] free slim slot

You said this terrifically!

lucky red casino login [url=https://reddog-casino.site/#]no deposit bonus codes 2020[/url] perfect pairs

Cheers. Ample info!

online fish tables sign up bonus red dog casino no deposit bonus 2023 red dog no deposit casino bonus codes for existing players

Whoa many of superb material!

online slots free no download https://reddog-casino.site/ valid no deposit bonus codes for red dog casino

Seriously plenty of helpful tips.

neosurf casino mobil roulette rtg games https://reddog-casino.site/ online video poker game [url=https://reddog-casino.site/#]red dog casino review[/url] red dog online casino

Thanks! I like it.

play craps online for money reddog no deposit bonus play free baccarat

You actually expressed this fantastically.

best online craps [url=https://red-dogcasino.website/#]reddog casino no deposit bonus[/url] aladdin casino online

You reported it effectively.

cash bandits 3 [url=https://red-dogcasino.website/#]red dog casino no deposit bonus codes[/url] 10 deposit casino

You mentioned that perfectly!

online casino credit cards [url=https://red-dogcasino.website/#]red dog casino login[/url] rouletteonline

Really quite a lot of useful advice.

video poker for real money $10 minimum deposit casino usa credit card online casino

You revealed that fantastically!

minimum deposit online casino red dog no deposit codes red dog casino 100 no deposit bonus codes 2023 https://red-dogcasino.website/ rudolphs revenge [url=https://red-dogcasino.website/#]reddog casino no deposit bonus[/url] play slots for free no download

Fantastic content. Appreciate it!

free no download casino games red dog casino free chip red dog casino 100 no deposit bonus codes 2023

You mentioned that superbly!

roulette real money https://red-dogcasino.website/ free chip no deposit bonus

Аренда инструмента предоставляет множество преимуществ, особенно для тех, кто редко использует специализированные инструменты или не хочет тратить деньги на их покупку. Вот несколько преимуществ аренды инструмента

взять в аренду электроинструмент [url=https://prokat888.ru/]https://prokat888.ru/[/url].

Well spoken certainly. !

su bc football game bc game crash bc game telegram

Kudos! I value this!

1 вин проверка сайта и обзор казино 1win 1вин 1win бк 1win partenaire https://1winoficialnyj.online/ 1win как играть на бонусы [url=https://1winoficialnyj.online/#]1win букмекерская контора регистрация[/url] 1win бет зеркало

Wow a lot of superb info.

регистрация 1win [url=https://1winvhod.online/#]1win бк зеркало[/url] 1win бонус за установку приложения

Info clearly considered.!

сегодня 1win https://1winoficialnyj.online/ 1win партнер

Regards! I value this.

как использовать бонусы спорт в 1win [url=https://1winvhod.online/#]1win регистрация[/url] 1win официальный вход

Tips clearly utilized!!

1win и бонусы 1вин 1win бонус [url=https://1winvhod.online/#]1win casino games xyz игры[/url] 1win букмекерская промокод

Good write ups. Regards!

1win скачать приложение на айфон 1win ставки на спорт обзор актуальные бонусы 1win 2023 промокод 1win на сегодня https://1winoficialnyj.online/ 1win apk download [url=https://1winoficialnyj.online/#]1win промокод[/url] 1win букмекерская контора официальный сайт

Reliable content. With thanks.

как вывести деньги с 1win на карту 1win 1win зеркало сейчас online https://1winoficialnyj.site/ 1win зеркало сайта [url=https://1winoficialnyj.site/#]1win бк[/url] 1win букмекерская скачать приложение

Kudos! I value it!

1win приложение зеркало [url=https://1winvhod.online/#]1win отзывы[/url] 1win вывод средств сколько ждать

Truly a lot of valuable info.

1win развод [url=https://1winvhod.online/#]1win сколько идет вывод[/url] 1win бездепозитный бонус

Many thanks! Lots of postings!

1win самолетик https://1winoficialnyj.site/ 1win скачать официальное приложение на андроид бесплатно

Regards! A lot of tips.

1win зеркало рабочее на сегодня прямо сейчас [url=https://1winvhod.online/#]1win официальный сайт зеркало скачать[/url] 1win официальный сайт вход в личный кабинет

You’ve made your point pretty nicely!!

1win бонусы на спорт как использовать 1win скачать android 1win детальная проверка ван вин 1вин промокоды https://1winoficialnyj.site/ промокоды для 1win [url=https://1winoficialnyj.site/#]1win бонусы спорт как использовать[/url] 1win зеркало рабочее на сегодня прямо

Amazing all kinds of useful material!

cloud9 1win aviator 1win игра как я и 1вин стратегия aviator 1win игра https://1winoficialnyj.site/ что такое ваучер в 1win [url=https://1winoficialnyj.site/#]1win официальный[/url] 1win-rate com

Truly plenty of amazing advice!

1win tricked прогноз промокод 1win 1win это https://1winoficialnyj.website/ 1win на телефон [url=https://1winoficialnyj.website/#]1win скачать телефон[/url] как вывести деньги с 1win

This is nicely put. !

1win скачать на айфон [url=https://1winvhod.online/#]как вывести деньги 1win[/url] 1 вин проверка сайта и обзор казино 1win 1вин

Very well voiced without a doubt. .

что такое бонусы спорт в 1win [url=https://1winvhod.online/#]1win скачать на айфон[/url] 1win андроид

Thanks a lot. I appreciate this!

1win бесплатно мобильный [url=https://1winvhod.online/#]1win букмекерская[/url] 1win бонус спорт как использовать

Seriously all kinds of terrific material.

промокод 1win 2023 1win букмекерская контора скачать приложение 1win casino официальный сайт https://1winoficialnyj.website/ como usar o bonus do 1win [url=https://1winoficialnyj.website/#]1win ваучер на деньги[/url] 1win cassino

Cheers! Helpful information!

1win мобильное https://1winoficialnyj.website/ 1win зеркало скачать на мобильный

Cheers. Terrific information.

как отыграть бонус 1win 1win aviator app download бонусы 1win https://1winoficialnyj.website/ 1win зеркало рабочее на сегодня прямо online [url=https://1winoficialnyj.website/#]1win скачать онлайн[/url] как потратить бонусы казино 1win

Kudos. I appreciate this!

1win bonus ваучеры для 1win ваучер в 1win https://1winregistracija.online/ как использовать бонусы 1win казино [url=https://1winregistracija.online/#]как использовать бонусы казино в 1win[/url] 1win как пополнить

You revealed it perfectly!

1win bet apk [url=https://1winvhod.online/#]скачать 1win на андроид с официального сайта[/url] 1win промокод при регистрации 2024

Great postings. With thanks.

1win как использовать бонусы [url=https://1winvhod.online/#]1win бк[/url] как играть бонусами 1win

Nicely put. Appreciate it!

plinko casino 1win [url=https://1winvhod.online/#]1win скачать на телефон андроид бесплатно[/url] как играть на бонусный счет 1win

Many thanks. Numerous content!

1win android 1win зеркало сайта игра как я и 1вин стратегия aviator 1win игра

Appreciate it! Quite a lot of postings.

aviator 1win игра https://1winregistracija.online/ 1win é confiável

Really all kinds of beneficial data!

lucky jet игра 1win 1win зеркало lucky jet в 1win как обыграть отзывы казино https://1winregistracija.online/ 1win скачать приложение [url=https://1winregistracija.online/#]1win viperio[/url] команда 1win

You actually said this fantastically.

фриспины 1win 1win сайт зеркало 1win forze

Thanks a lot. Lots of facts!

бонусный счет 1win ваучер 1win сайт 1win вход

Thanks a lot! Useful stuff.

ежедневная бесплатная лотерея 1win бонусы казино 1win 1win букмекерская скачать на айфон https://1winregistracija.online/ 1win скачать на андроид бесплатно [url=https://1winregistracija.online/#]1win вход[/url] 1win бесплатно андроид

Great facts, Many thanks!

1win бесплатно официальное приложение 1win зеркало скачать приложение стратегия jet 1win лаки джет как играть в jet https://1winvhod.online/ 1win скачать последнюю версию [url=https://1winvhod.online/#]актуальное зеркало бк 1win[/url] как пользоваться бонусами 1win

Appreciate it. A lot of info!

lucky jet в 1win как обыграть отзывы вывод денег с 1win 1win промокод без депозита https://1winvhod.online/ бонусы 1win [url=https://1winvhod.online/#]ежедневная бесплатная лотерея 1win[/url] 1win casino зеркало

Many thanks, Numerous forum posts.

1win официальное зеркало 1win букмекерская 1win официальный 1win app store

Factor very well used..

“””отзывы о сайте 1win””” https://1winvhod.online/ 1win официальный сайт регистрация

Very well voiced really. !

обзор актуальные бонусы 1win 2023 промокод 1win на сегодня 1win казахстан 1win слоты и 1вин казино 1win казино https://1winvhod.online/ 1win casino скачать [url=https://1winvhod.online/#]1win букмекерская контора[/url] верификация 1win

Kudos. Numerous advice.

1win kz вход бонусы на спорт 1win действующее зеркало 1win https://1win-vhod.online/ 1win казино отзывы [url=https://1win-vhod.online/#]скачать 1win на андроид с официального сайта[/url] 1win зеркало на сегодня

Awesome tips. Regards.

казино 1xbet скачать 1xbet зеркало официальный сайт 1xbet мобильная версия скачать на андроид

Nicely put, Appreciate it!

1win ru скачать [url=https://1winoficialnyj.online/#]1win зеркало[/url] 1win cs go матчи

Cheers, Loads of stuff!

1win зеркало сайта 1win мобильное приложение 1win зеркало сегодня прямо сейчас

You stated that perfectly!

bonus casino 1win [url=https://1winoficialnyj.online/#]1win зеркало скачать[/url] 1win official site

Truly lots of wonderful facts!

1win промокод россия 1win промокод на деньги 1win online casino https://1win-vhod.online/ 1win баланс 1000 [url=https://1win-vhod.online/#]1win букмекерская контора[/url] 1win casino сайт

Nicely put. Thanks a lot!

1win aviator demo 1win lucky jet 1win бонус на спорт

With thanks. Numerous information.

1win официальный сайт зеркало [url=https://1winoficialnyj.online/#]1win букмекерская контора[/url] jet best big win strategy jet winning tricks jet 1win

Thanks a lot. A lot of facts!

как потратить бонусы 1win [url=https://1winoficialnyj.site/#]бк 1win[/url] 1win affiliate

You actually expressed that superbly.

скачать 1win что делать с бонусами на 1win aviator game 1win

Very well spoken of course! !

1win зеркало скачать [url=https://1winoficialnyj.site/#]как пополнить 1win[/url] авиатор игра 1win

You actually suggested it wonderfully!

1win casino скачать как использовать бонусы казино в 1win как пользоваться бонусами казино в 1win

This is nicely put. !

1win букмекерская контора официальный сайт вход [url=https://1winoficialnyj.site/#]зеркало 1win[/url] промокод при регистрации 1win

Nicely put, Thank you.

1win не работает 1win как использовать бонусы бесплатные ваучеры 1win

You stated it well.

lucky jet 1win [url=https://1winoficialnyj.website/#]1win liquipedia[/url] ваучеры 1win 2023

Kudos! Awesome information!

1win партнерка вход как использовать бонусы казино в 1win зеркало 1win работающее сегодня

Regards, I value it.

1win как установить [url=https://1winoficialnyj.website/#]1win мобильное приложение скачать на андроид[/url] 1win команда кс го

You have made your point.

1win официальный скачать на андроид 1win ставки 1win сайт ставки

Cheers. Excellent stuff!

бонус промокод 1win [url=https://1winoficialnyj.website/#]1win официальный сайт скачать[/url] как использовать бонусы казино в 1win

Amazing material, Thanks a lot!

1win вывод средств сколько ждать 1вин обзор и слотов 1win онлайн 1вин 1win бесплатно мобильный

You actually expressed this fantastically!

1win кс го [url=https://1winregistracija.online/#]зеркало 1win[/url] 1win partners отзывы

Incredible a lot of excellent data!

code promo 1win 1win официальный сайт 1win casino скачать

Regards. Lots of content!

скачать 1win на андроид бесплатно зеркало [url=https://1winregistracija.online/#]1win бк[/url] 1win букмекерская зеркало онлайн

Nicely put, Many thanks!

1win affiliate program 1win рабочее зеркало бонус на спорт 1win

With thanks. Ample data.

авиатор игра 1win [url=https://1winregistracija.online/#]1win рабочее зеркало[/url] как скачать 1win на айфон

Lovely material. Thank you!

1win aposta 1win официальный сайт букмекерской конторы 1win

Thanks. I like it!

1 вин проверка сайта и обзор казино 1win 1вин [url=https://1winvhod.online/#]1win букмекерская контора официальный[/url] 1win cs

Thank you! Loads of content.

1win зеркало рабочее 1win казино 1win сайт скачать

Incredible tons of good information!

1win промокод для бонуса [url=https://1winvhod.online/#]1win отзывы[/url] 1win лаки джет

Many thanks! I enjoy it!

как пользоваться бонусами 1win 1win букмекерская контора мобильная источник трафика 1win

Are you eager to start a healthier lifestyle? Losing weight can be a challenge, but with the right support, it’s definitely achievable. Whether you’re looking to shed a few pounds or make a significant change, our product could be the key you need. Learn more about [url=https://phentermine.pw]Premium Phentermine – Order Online[/url] can assist you in reaching your fitness goals. It’s time to take the first step and see the amazing results for yourself!

Аренда инструмента в название с инструментом без У нас доступны последние модели инструментов решение для Качественный инструмент выгодно в нашем сервисе

Аренда инструмента крупных задач

Экономьте деньги на покупке инструмента с нашими услугами проката

Правильное решение для ремонта автомобиля нет инструмента? Не проблема, в нашу компанию за инструментом!

Расширьте свои возможности с качественным инструментом из нашего сервиса

Аренда инструмента для садовых работ

Не тяните деньги на покупку инструмента, а берите в прокат инструмент для разнообразных задач в наличии

Большой выбор инструмента для выполнения различных работ

Качественная помощь в выборе нужного инструмента от специалистов нашей компании

Будьте в плюсе с услугами Арендовать инструмента для строительства дома или квартиры

Наша компания – лучший партнер в аренде инструмента

Надежный помощник для ремонтных работ – в нашем прокате инструмента

Не можете определиться с выбором? Мы поможем с подбором инструмента в нашем сервисе.

магазин проката [url=https://www.meteor-perm.ru]https://www.meteor-perm.ru[/url].

Xanax – Your partner in tackling anxiety. Find out how [url=https://get-xanax.com/]Buy Our Xanax for Immediate Anxiety Relief[/url] can help you in finding mental calm. Start your path to relief now.

Feeling overwhelmed by everyday anxiety? Discover a path to serenity with Xanax. Xanax is designed to assist you in managing daily stress. See how [url=https://get-xanax.com/]Xanax: Your Key to Anxiety Relief[/url] can transform your life. Start your journey to a more peaceful existence today!

Xanax: A new approach to handle anxiety. Discover how [url=https://get-xanax.com/]Xanax: Stop Your Anxiety Today[/url] can support your quest for calmness. Embark on your journey towards tranquility now.

Are you in search of reliable anxiety relief? Check out how Xanax can make a difference. Whether your goal is to achieve better mental balance, [url=https://xanaxtips.com/]Xanax – Your Choice for Calmness[/url] might be the right choice. Start with us today and enjoy a stress-free life!

Factor effectively taken!.

1win casino промокод [url=https://1wincasino.milesnice.com/#]1win вход в личный кабинет[/url] 1win отзывы казино

Many thanks, Plenty of tips.

1win автоматы слоты https://1wincasino.milesnice.com/ 1win cs

Really all kinds of fantastic information.

aviator игра 1win скачать [url=https://1win-casino.milesnice.com/#]1win букмекерская контора мобильная версия[/url] ежедневная бесплатная лотерея 1win

Incredible tons of superb info.

как ввести промокод в 1win plinko 1win как пользоваться бонусами в 1win https://1win-casino.milesnice.com/ 1win online [url=https://1win-casino.milesnice.com/#]1win ставки скачать на андроид[/url] промокод 1win при пополнении

Cheers. I value it.

1win coin [url=https://1winkazino.milesnice.com/#]1win букмекерская контора мобильная[/url] официальный сайт 1win

You revealed it exceptionally well.

вся правда об алгоритмах aviator 1win обзор [url=https://1winoficialnyj.milesnice.com/#]1win онлайн[/url] бонусы спорт в 1win

You made your position pretty well.!

1win casino review 1win онлайн 1win букмекерская зеркало онлайн https://1winoficialnyj.milesnice.com/ 1win букмекерская контора официальный [url=https://1winoficialnyj.milesnice.com/#]1win é confiavel[/url] 1win партнерка вход

Really many of valuable information.

1win скачать apk 1win рабочее зеркало 1win украина

Cheers. Great information!

1win сайт скачать https://1winoficialnyj.milesnice.com/ как воспользоваться бонусами 1win

Good write ups. Many thanks!

1win телефон мобильный телефон промокоды 1win 1win телеграм https://1winregistracija.milesnice.com/ 1win es seguro [url=https://1winregistracija.milesnice.com/#]1win официальный сайт войти[/url] 1win 2024

Truly tons of useful material.

сколько ждать вывод с 1win 1win онлайн 1win отзывы игроков

You made your point.

1win приложение андроид [url=https://1winvhod.milesnice.com/#]скачать 1win на андроид[/url] промокод 1win 2023

Thanks, I appreciate it.

1win бонус 5000 как использовать 1win рабочее зеркало на сегодня lucky jet в 1win как обыграть отзывы https://1winvhod.milesnice.com/ 1win скачать мобильное приложение [url=https://1winvhod.milesnice.com/#]1win apk ios[/url] download 1win app

Fine posts. Regards!

1win kz скачать на айфон 1win официальный сайт скачать 1win официальный зеркало букмекерская контора

You have made your stand quite clearly..

1win kazakhstan https://1winvhod.milesnice.com/ 1win обзор

This is nicely expressed! .

сайт 1win [url=https://1win-vhod.milesnice.com/#]1win регистрация[/url] 1win сколько идет вывод

Lovely stuff, Kudos.

1win букмекерская контора вход 1win официальный сайт войти актуальное зеркало бк 1win https://1win-vhod.milesnice.com/ 1win бонус на спорт [url=https://1win-vhod.milesnice.com/#]1win скачать[/url] 1win sprout

Kudos. A lot of content.

1win отзывы 1win casino 1win регистрация ставки

Superb posts, With thanks!

1win бесплатно [url=https://1winzerkalo.milesnice.com/#]1win официальный сайт бесплатно онлайн[/url] отзывы 1win lucky jet

You said it perfectly.!

1win скачать на телефон 1win мобильное приложение скачать 1win partners скачать https://1winzerkalo.milesnice.com/ 1win bonus [url=https://1winzerkalo.milesnice.com/#]1win бк[/url] 1win casino online

Wow many of terrific material.

проверка 1win как использовать бонусы казино в 1win 1win app real or fake

Superb information, Thanks.

1win промокод на фрибет [url=https://zerkalo1win.milesnice.com/#]лаки джет 1win официальный сайт[/url] 1win актуальное зеркало онлайн

Thanks, Quite a lot of stuff.

1win cassino 1win партнер 1win мобильная версия https://zerkalo1win.milesnice.com/ 1win лаки джет [url=https://zerkalo1win.milesnice.com/#]скачать 1win на айфон[/url] “””1win скачать на android”””

With thanks! I enjoy it.

1win бонус на спорт 1win casino 1win проверяем и бонусы казино 1win казино

Nicely put. Appreciate it!

как потратить бонусы на казино в 1win [url=https://zerkalo-1win.milesnice.com/#]бонусы казино 1win[/url] 1win как ставить бонусы

Nicely spoken truly. !

1win бонусы на спорт как использовать 1win бесплатная ставка 1вин обзор и слотов 1win онлайн 1вин https://zerkalo-1win.milesnice.com/ bonus casino 1win [url=https://zerkalo-1win.milesnice.com/#]1win tv[/url] plinko 1win

Excellent postings. With thanks.

1win пополнение 1win вход 1win промокод 2024

You actually revealed it effectively!

1win промокод без депозита https://zerkalo-1win.milesnice.com/ как использовать бонусы спорт в 1win

essay topics for the rocking horse winner https://buy-essays-online-dsd32109.jaiblogs.com/49994586/the-2-minute-rule-for-buy-essays-online-dsd i love music essay

You actually revealed that terrifically!

ваучер 1win https://1win-vhod.milesnice.com/ “””1win скачать на android”””

You actually stated this very well!

código promocional 1win [url=https://zerkalo-1win.milesnice.com/#]1win вход[/url] 1win бк зеркало

Nicely put, Kudos!

1win регистрация на сайте бк 1win официальный сайт 1win aviator https://zerkalo-1win.milesnice.com/ código promocional 1win [url=https://zerkalo-1win.milesnice.com/#]1win бонус при регистрации[/url] 1win телефон приложение

Reliable postings. Thanks.

1win слоты 1win скачать на андроид 1win букмекерская приложение на андроид

Really a good deal of superb information.

промокод на 1win на сегодня https://1winzerkalo.milesnice.com/ 1win ставки онлайн

Excellent facts. Many thanks!

1xbet не выводит деньги [url=https://1xbetcasino.milesnice.com/#]1xbet зеркало казино[/url] как зарегистрироваться в 1xbet

You expressed this terrifically!

как правильно зарегистрироваться на 1xbet 1xbet зеркало рабочее на сегодня букмекерская контора 1xbet https://1xbetcasino.milesnice.com/ 1xbet скачать 2023 на андроид [url=https://1xbetcasino.milesnice.com/#]1xbet сайт[/url] plinko 1xbet

Nicely put. Thanks a lot!

скачать старый 1xbet на андроид 1xbet zerkalo 1xbet partners

Fantastic information. Cheers!

1win casino сайт https://zerkalo1win.milesnice.com/ 1win run

You made your point!

1xbet skachat [url=https://1xbet-casino.milesnice.com/#]актуальное зеркало 1xbet[/url] 1xbet на андроид

Cheers, A lot of info!

1xbet зеркалр 1xbet login 1xbet скачать на андроид бесплатно последняя версия https://1xbet-casino.milesnice.com/ игра 1xbet [url=https://1xbet-casino.milesnice.com/#]1xbet приложение[/url] казино 1xbet официальный сайт

You actually revealed this effectively.

1xbet скачати 1xbet nigeria login bonus 1xbet

This is nicely said! .

1вин реальный обзор 1win зеркало 1вин https://zerkalo-1win.milesnice.com/ 1win условия бонуса

Regards. I like this.

1xbet пополнение счета [url=https://1xbetkazino.milesnice.com/#]1xbet скачать на айфон[/url] 1xbet официальный сайт скачать приложение

You expressed that really well!

1xbet зеркало рабочее на сегодня 2024 1xbet скачать бесплатно 1xbet скачать на телефон андроид официальный сайт https://1xbetkazino.milesnice.com/ скачать 1xbet скачать 1иксбет [url=https://1xbetkazino.milesnice.com/#]скачать 1xbet зеркало[/url] лучшие слоты 1xbet

Terrific material, Kudos!

1xbet stream https://1xbetcasino.milesnice.com/ 1xbet официальный сайт мобильная версия скачать бесплатно

Good forum posts, Thanks.

приложение 1xbet [url=https://1xbetoficialnyj.milesnice.com/#]скачать 1xbet на айфон[/url] 1xbet apk скачать

You expressed this effectively!

1xbet зеркало 1xbet игровые автоматы скачать на андроид бесплатно скачать 1xbet на android https://1xbetoficialnyj.milesnice.com/ 1xbet mobi apk скачать на андроид [url=https://1xbetoficialnyj.milesnice.com/#]1xbet скачать на андроид бесплатно[/url] скачать старый 1xbet на андроид

Perfectly spoken of course! !

1xbet фрибет за регистрацию 1xbet partners 1xbet prediction for today

Аренда инструмента в Красноярске

аренда инструмента в красноярске без залога [url=https://www.prokat888.ru/#аренда-инструмента-в-красноярске-без-залога]https://www.prokat888.ru/[/url].

Control your stress effectively with Xanax. See how [url=https://www.winxanax.com/]Ease Your Mind with Xanax[/url] can help in your life. Start your journey to a more relaxed you today!

Xanax: Proven relief from everyday stress. Learn more about [url=https://xanaxtips.com/]Xanax: The Best Option for Anxiety Control[/url] and how it can transform your daily life. Take the step towards a calmer existence today.

Discover the power of Xanax in controlling anxiety. [url=https://xanaxtips.com/]Xanax: Your Path to a Stress-Free Life[/url] could be your key to a more relaxed lifestyle. Embark on your journey today!

Перетянуть мягкую мебель в доме: Дать новый вид старой мебели: Когда перетягивать мебель своими руками: Выбор ткани для перетяжки мягкой мебели: Как сэкономить на перетяжке мягкой мебели: Что нужно знать перед перетяжкой мебели: основные правила

[url=https://art-restor.ru/]перетяжка мягкой мебели[/url].

Как усовершенствовать интерьер с помощью перетяжки мягкой мебели

Забота о жилье – это забота о вашем комфорте. Теплоизоляция стен – это не только изысканный облик, но и гарантия сохранения тепла в вашем уголке уюта. Наша команда, коллектив экспертов, предлагаем вам превратить ваш дом в прекрасное место для жизни.

Наши творческие работы – это не просто утепление, это творческое воплощение с каждым шагом. Мы осуществляем гармонии между внешним видом и практической ценностью, чтобы ваш дом превратился не только уютным, но и роскошным.

И самое существенное – доступная стоимость! Мы уверены, что профессиональные услуги не должны быть неподъемными по цене. [url=https://ppu-prof.ru/]Утепление фасада расценка[/url] начинается всего от 1250 рублей за квадратный метр.

Инновационные технологии и материалы высокого стандарта позволяют нам создавать утепление, обеспечивающее долговечность и надежность. Оставьте в прошлом холодные стены и лишние затраты на отопление – наше утепление станет вашим надежной преградой перед холодом.

Подробнее на [url=https://ppu-prof.ru/]ppu-prof.ru/[/url]

Не откладывайте на потом заботу о счастье в вашем уголке. Обращайтесь к опытным мастерам, и ваше жилье станет настоящим творческим шедевром, которое подарит вам тепло и уют. Вместе мы создадим обители, где вам будет по-настоящему комфортно!

You actually expressed this effectively.

primitive era 10000 bc game mod apk bc game casino review shitlink bc game

Incredible loads of useful info.

pharmacy in canada [url=https://canadiandrugsus.com/#]canadian pharmacies online[/url] trusted online pharmacy reviews

Amazing data. With thanks.

online pharmacy viagra [url=https://canadiandrugsus.com/#]online pharmacy india[/url] pharmacy prices

Amazing loads of terrific info!

canadian pharmacy meds viagra canada canadian pharmacy 365 https://canadiandrugsus.com/ cheap medications [url=https://canadiandrugsus.com/#]canadian pharmacies that are legit[/url] canada pharmaceuticals online

Wow plenty of useful advice!

canada pharmacies [url=https://canadianpharmacylist.com/#]medical information online[/url] prescription drug

Cheers, I value this.

prescription drug price comparison online pharmacy without a prescription online pharmacy school https://canadianpharmacylist.com/ walmart pharmacy price check [url=https://canadianpharmacylist.com/#]canada pharmacies/account[/url] online canadian pharmacy

Point effectively regarded..

medical pharmacy [url=https://canadianpillsusa.com/#]viagra canada[/url] buying prescription drugs canada

Seriously loads of excellent advice.

canada drugs walmart pharmacy online 24 hour pharmacy https://canadianpillsusa.com/ mexican border pharmacies [url=https://canadianpillsusa.com/#]canadian drugs online pharmacy[/url] pharmacy drugstore online

Great material. Appreciate it!

cialis generic pharmacy online [url=https://canadiantabsusa.com/#]canadian pharmacies-24h[/url] canada viagra

Wow a good deal of very good tips.

cvs online pharmacy buy drugs online compare prescription prices https://canadiantabsusa.com/ canadian pharmacy cialis 20mg [url=https://canadiantabsusa.com/#]canada drug[/url] pharmacy tech

Factor nicely applied.!

discount pharmaceuticals [url=https://northwestpharmacylabs.com/#]legal canadian prescription drugs online[/url] canadian pharmacies that are legit

Perfectly voiced indeed. .

panacea pharmacy ed meds online without doctor prescription online pharmacy without prescription https://northwestpharmacylabs.com/ compare prescription prices [url=https://northwestpharmacylabs.com/#]health canada drug database[/url] canadian pharmacy viagra brand

Whoa tons of very good data.

drugs from canada with prescription [url=https://sopharmsn.com/#]cvs online pharmacy[/url] canadian prescription drugs

Whoa lots of very good facts.

canadian drugs pharmacy canadian online pharmacies canadian pharmacy no prescription needed https://sopharmsn.com/ pharmacy online shopping [url=https://sopharmsn.com/#]international pharmacy[/url] buy generic viagra online

Thanks, Helpful stuff!

best online pharmacies no prescription pharmacy technician classes online free pharmacies shipping to usa

Perfectly expressed indeed. .

canada pharmaceuticals online generic https://canadiandrugsus.com/ pharmacy online mexico

Great content. Many thanks!

pharmacy canada online pharmacies of canada canadian rx

Really quite a lot of beneficial facts.

drugs from canada online https://canadianpharmacylist.com/ international pharmacy

Thanks! I value this.

canada drug pharmacy https://canadianpillsusa.com/ cheap canadian drugs

Superb forum posts, Many thanks!

canada pharmaceutical online ordering rx pharmacy cheap drugs

Regards. A lot of content!

medication costs https://canadiantabsusa.com/ canadian prescriptions online

Superb postings. Thanks!

national pharmacies online navarro pharmacy miami canadadrugstore365

Regards. Good stuff!

drugstore online https://northwestpharmacylabs.com/ canada pharmaceuticals online

Thanks a lot, Useful information.

prescription drugs from canada online canadian pharmaceuticals online safe canadadrugs pharmacy

You have made your position pretty nicely.!

cheap prescription drugs https://sopharmsn.com/ london drugs canada

Join the fun at our Mexican online casino and discover why we’re the hottest destination for players seeking big wins and non-stop entertainment. [url=https://calientecasinoa.com/]caliente casino en linea[/url] la clave para una vida lujosa.

Regards, Quite a lot of postings!

best canadian pharmacies canada pharmacy online online pharmacies canada

Incredible loads of helpful data.

canadian pharmacy drugs online [url=https://canadiandrugsus.com/#]ed meds online without doctor prescription[/url] navarro pharmacy

You have made the point.

canadian king pharmacy best online international pharmacies pharmacy cost comparison https://canadiandrugsus.com/ overseas pharmacy forum [url=https://canadiandrugsus.com/#]canada drug[/url] shoppers pharmacy

Info very well taken.!

medical pharmacies [url=https://canadianpharmacylist.com/#]online pharmacy viagra[/url] drugs online

Amazing loads of great facts!

online order medicine drug stores near me pharmacie canadienne https://canadianpharmacylist.com/ navarro pharmacy miami [url=https://canadianpharmacylist.com/#]shoppers drug mart canada[/url] canadian pharmacy no prescription

You said it very well..

online pharmacy canada [url=https://canadianpillsusa.com/#]king pharmacy[/url] medical information online

Very good facts, Thank you.

canadia online pharmacy legal canadian prescription drugs online pharmacie https://canadianpillsusa.com/ prescription drug cost [url=https://canadianpillsusa.com/#]mexican pharmacy online[/url] best online pharmacies canada

You said it very well.!

online canadian pharcharmy [url=https://canadiantabsusa.com/#]canadian pharmaceuticals online[/url] approved canadian pharmacies online

Very good write ups. Cheers!

mail order pharmacy canadian pharmacy cialis northwestpharmacy https://canadiantabsusa.com/ canadian online pharmacies legitimate [url=https://canadiantabsusa.com/#]canadian pharmaceuticals[/url] canada pharmaceuticals online generic

Nicely put. Many thanks!

mexican border pharmacies [url=https://northwestpharmacylabs.com/#]mail order pharmacies[/url] northwest pharmaceuticals canada

Great postings. Thank you!

canadian pharmacy 365 rx pharmacy online pharmacy canada https://northwestpharmacylabs.com/ online pharmacy reviews [url=https://northwestpharmacylabs.com/#]online pharmacy india[/url] shoppers drug mart pharmacy

Nicely put, With thanks!

canadian pharmacy meds trust pharmacy canada cheap prescription drugs https://sopharmsn.com/ canadian pharmacy online canada [url=https://sopharmsn.com/#]compound pharmacy[/url] canadian mail order pharmacies

You suggested this wonderfully!

apollo pharmacy online canadian viagra online medicine shopping

Thanks, Awesome information!

medication costs https://canadiandrugsus.com/ cialis online

Incredible quite a lot of excellent material!

best non prescription online pharmacies canadadrugsonline cialis pharmacy online

Уважаемые Партнеры!

Вводим вам свежее слово в мире стилистики домашней обстановки – шторы плиссе. Если вы стремитесь к великолепию в всякой аспекте вашего домашнего, то эти занавеси выберутся замечательным паттерном для вас.

Что делает шторы плиссе такими особенными? Они объединяют в себе в себе изысканность, действенность и пользу. Благодаря особой архитектуре, современным материалам, шторы плиссе идеально гармонизируются с для какого бы то ни интерьера, будь то гостиная, ложа, плита или профессиональное пространство.

Закажите [url=https://tulpan-pmr.ru]шторы плиссе на раму[/url] – отразите уют и превосходство в вашем доме!

Чем привлекательны шторы плиссе для вас? Во-первых, их поразительный образ, который добавляет к прелесть и шик вашему жилищу. Вы можете выбирать из различных структур, оттенков и подходов, чтобы акцентировать уникальность вашего дома.

Кроме того, шторы плиссе предлагают полный базар функциональных вариантов. Они могут регулировать уровень света в пространстве, покрывать от солнечного света, предоставлять закрытость и создавать уютную обстановку в вашем доме.

Мы сайт: [url=https://tulpan-pmr.ru]https://www.tulpan-pmr.ru[/url]

Мы поддержим вам подобрать шторы плиссе, какие прекрасно соответствуют для вашего дизайна!

Incredible quite a lot of helpful facts!

canadian king pharmacy https://canadianpharmacylist.com/ canadian pharmaceuticals online

Thank you, Valuable stuff.

compound pharmacy compound pharmacy best online canadian pharmacy

Amazing quite a lot of superb info!

canadian rx https://canadianpillsusa.com/ legal canadian prescription drugs online

You said it adequately.!

canada drugs online canadian online pharmacy drugs online

Information certainly utilized..

pharmacies shipping to usa https://canadiantabsusa.com/ rx price comparison

You actually revealed this wonderfully!

canadian drug legal canadian prescription drugs online prescription drug cost

Very good postings, Many thanks.

best online pharmacies no prescription https://northwestpharmacylabs.com/ canada drugs online pharmacy

Thanks a lot. I enjoy it.

canada prescription plus pharmacy [url=https://canadiandrugsus.com/#]list of approved canadian pharmacies[/url] canada pharma limited

You actually expressed that terrifically.

overseas pharmacy forum cialis canadian pharmacy canada pharmacies online pharmacy https://canadiandrugsus.com/ pharmacy price comparison [url=https://canadiandrugsus.com/#]prescription pricing[/url] canadian meds

Lovely info. Appreciate it!

canadian drug stores online [url=https://canadianpharmacylist.com/#]canada pharmacies online[/url] discount pharmacy online

Wow many of wonderful data!

canadian pharmacy without prescription canadadrugs online medicine to buy https://canadianpharmacylist.com/ fda approved canadian online pharmacies [url=https://canadianpharmacylist.com/#]drugs for sale[/url] discount pharmacy

You explained it wonderfully.

discount canadian drugs [url=https://canadianpillsusa.com/#]online pharmacy usa[/url] top rated canadian pharmacies online

Thanks a lot, Valuable stuff.

discount drugs online pharmacy list of legitimate canadian pharmacies canadian pharmacies shipping to usa https://canadianpillsusa.com/ pharmacy cheap no prescription [url=https://canadianpillsusa.com/#]ed meds online[/url] online discount pharmacy

You’ve made your point very clearly..

buying drugs canada [url=https://canadiantabsusa.com/#]canada drug pharmacy[/url] cheap viagra online canadian pharmacy

Wonderful data. Kudos.

prescription without a doctor’s prescription approved canadian pharmacies online best online pharmacy stores https://canadiantabsusa.com/ medical information online [url=https://canadiantabsusa.com/#]canadian pharmacies that ship to us[/url] prescription drug assistance

Seriously loads of useful advice!

canadian cialis [url=https://northwestpharmacylabs.com/#]online pharmacies[/url] northwest pharmacy

Nicely put, Thanks.

canadian pharmacy no prescription drug costs the canadian pharmacy https://northwestpharmacylabs.com/ mexican pharmacies [url=https://northwestpharmacylabs.com/#]erectile dysfunction pills[/url] meds online

Info well considered..

buy drugs online online pharmacies canada canadian drugstore online

You stated this perfectly!

ed meds online without doctor prescription https://canadiandrugsus.com/ online pharmacy canada

Amazing forum posts. Kudos.

prescription drugs without prior prescription approved canadian online pharmacies canada online pharmacies

Amazing tons of valuable facts.

canada pharmacies/account https://canadianpharmacylist.com/ canadian viagra

Thanks a lot! An abundance of postings!

canada drugs pharmacy online walgreens online pharmacy legit online pharmacy

Wow loads of very good facts!

canadian pharmacy online https://canadianpillsusa.com/ no prescription pharmacy

Nicely put, Appreciate it!

pharmacies shipping to usa best erectile dysfunction pills pharmacy intern

Regards, Wonderful information!

discount pharmaceuticals https://canadiantabsusa.com/ safeway pharmacy

Nicely put, Cheers!

online rx pharmacy online canadian pharmacy mexican pharmacies shipping to usa

You suggested it effectively!

online pharmacies legitimate https://northwestpharmacylabs.com/ canada pharmacies prescription drugs

With thanks, Good information.

canadian pharmacy online viagra erection pills buy generic viagra online

You actually suggested it wonderfully!

pharmacy tech https://sopharmsn.com/ modafinil online pharmacy

This is nicely put. !

more https://shallbd.com/pt/entendendo-os-graficos-eod-um-guia-abrangente-titulo-do-site/

more hints https://shallbd.com/ko/obsyeon-georaeeseo-peurimieom-gyesan-ihaehagi/

Amazing material, Thanks a lot!

go right here https://shallbd.com/zh/ru-he-ping-gu-gu-piao-xin-chou/

over at this website https://shallbd.com/id/strategi-harian-macd-panduan-lengkap/

This is nicely expressed. !

find out more [url=https://shallbd.com/zh/bu-lin-dai-dui-ri-nei-jiao-yi-you-xiao-ma-fa-xian-li-bi/]best site[/url]

click to read [url=https://shallbd.com/id/cara-mengidentifikasi-kandil-bullish-panduan-komprehensif/]sneak a peek at this web-site.[/url]

Factor certainly utilized!.

important link [url=https://shallbd.com/ko/georaee-gajang-jeoghabhan-baineori-obsyeon-bigyo-jonghab-gaideu/]you can try these out[/url]

what is it worth https://shallbd.com/es/aprenda-a-guardar-una-plantilla-mt4-en-4-sencillos-pasos/

Thank you. I enjoy it!

on yahoo [url=https://shallbd.com/ko/authors/michael-clarke/]visit the website[/url]

official website [url=https://shallbd.com/es/comprender-las-opciones-sobre-acciones-de-los-empleados-de-gm-una-guia-completa/]try this site[/url]

Whoa tons of excellent tips.

useful link https://shallbd.com/zh/shi-yao-shi-pei-dui-jiao-yi-ce-lue-ju-li-shuo-ming/

get more information [url=https://shallbd.com/ko/att-jusigi-wae-ireohge-najeungayo-juga-haragyi-weonineul-alaboseyo/]use this link[/url]

Good tips. With thanks!

go to website https://shallbd.com/tr/isvicre-de-100-abd-dolarinin-degeri-nedir/

look here https://shallbd.com/tr/peru-sol-istikrari-para-birimindeki-dalgalanmalarin-derinlemesine-analizi/

With thanks, Quite a lot of information!

next https://shallbd.com/id/musim-perdagangan-penghasilan-dengan-opsi-kiat-dan-strategi/

this hyperlink https://shallbd.com/es/comprender-el-significado-de-cbi-en-la-banca-y-su-importancia/

You said that exceptionally well!

more https://shallbd.com/ko/teureidingeseo-beureikeuaus-jeonryageul-wihan-coegoyi-gaideu-suigryul-joheun-teureidingeul-sigbyeolhago-silhaenghaneun-bangbeob/

useful source https://shallbd.com/what-cookies-should-i-disable-a-beginner-s-guide-to-choosing-essential-cookies-on-websites/

You said it adequately..

image source https://shallbd.com/how-does-texas-split-assets-in-divorce-divorce-laws-in-texas/

her latest blog https://shallbd.com/id/memahami-perbedaan-antara-risiko-forex-dan-eksposur-forex/

Truly a lot of beneficial information.

browse around here https://shallbd.com/id/hari-hari-ketika-opera-forex-tidak-tersedia/

my review here https://shallbd.com/id/menjelajahi-peran-blockchain-dalam-perdagangan-energi-pengubah-permainan-untuk-industri/

You actually stated this perfectly.

click for more https://shallbd.com/can-moving-averages-be-effective-in-forex-trading/

about his https://shallbd.com/ko/obsyeoneuro-baedanggeumeul-badeul-su-issnayo-seolmyeong/

Very good information. Many thanks!

continued https://shallbd.com/zh/liao-jie-ou-yuan-dui-fei-lu-bin-bi-suo-de-zui-di-hui-lu-jie-sheng-da-bi-kai-zhi/

look at this https://shallbd.com/es/descubra-los-indicadores-que-bill-williams-creo-para-impulsar-su-estrategia-de-trading-sitename/

You mentioned this adequately.

page https://shallbd.com/tr/dort-yillik-donemde-yillik-buyume-oraninin-hesaplanmasi/

view website https://shallbd.com/zh/liao-jie-wai-hui-qi-huo-he-yue-de-da-xiao/

You have made your stand pretty effectively.!

check https://shallbd.com/is-bitcoin-arbitrage-profitable-find-out-here/

check here https://shallbd.com/zh/ou-yuan-dui-mei-yuan-shi-chang-he-shi-shou-pan/

Cheers. Numerous advice.

extra resources https://shallbd.com/zh/you-he-fa-de-wai-hui-jiao-yi-xin-hao-ma-jie-kai-zhen-xiang/

that guy https://shallbd.com/tr/hindistan-da-usd-para-birimi-tutabilir-ve-kullanabilir-miyim/

You’ve made your point!

helpful resources https://shallbd.com/zh/liao-jie-wai-hui-chai-jie-he-yue-jiao-yi-ji-zhi/

look these up https://shallbd.com/id/panduan-pemula-cara-bermain-di-bursa-santander-dan-memaksimalkan-keuntungan-anda/

This is nicely put. !

click to find out more https://shallbd.com/ko/teureidingeseo-sonjeolmaewa-iigsilhyeonyi-ihae-cobojareul-wihan-gaideu/

why not find out more https://shallbd.com/ko/metateureideo-4neun-myeonseingayo-alaya-hal-modeun-geoseul-alaboseyo/

Wow quite a lot of great facts.

discover this info here https://shallbd.com/zh/liao-jie-ibkr-xian-jin-zhang-hu-xuan-xiang-de-jie-suan-shi-jian/

anchor https://shallbd.com/zh/ru-he-jie-shi-kong-zhi-shang-xian-he-xia-xian-zhi-liang-kong-zhi-zhi-nan/

Fantastic information. With thanks!

check this site out [url=https://shallbd.com/pt/explorando-tipos-avancados-de-ordens-em-negociacoes-um-guia-abrangente/]blog[/url]

he has a good point https://shallbd.com/zh/liao-jie-mei-yuan-dui-ao-yuan-de-mei-ri-hui-lu/

Helpful write ups. Appreciate it.